Lifetime Gift Exclusion 2025. As a taxpayer, you usually only pay gift tax on the amounts that exceed the allotted lifetime gift tax exclusion, which was $12.92 million in 2025 and $13.61 million in 2025. The annual gift tax exclusion allows.

The annual gift tax applies to each person you give a gift. Federal annual and lifetime gift tax exclusion increase for 2025 regarding annual gifts, the current (2025) federal annual gift tax exclusion is $17,000.00 per u.s.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, The annual gift tax exclusion allows. The lifetime exclusion for 2025 is $12.92 million.

How Smart Are You About the Annual and Lifetime Gift Tax Exclusions, How the annual gift tax exclusion works? The us internal revenue service has announced that the annual gift tax exclusion is increasing in 2025 due to inflation.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, In 2025, taxpayers can gift up to $18,000 to a person without reporting it to the irs on a federal gift tax return. The annual gift tax exclusion for 2025 is $18,000 ($17,000 in 2025).

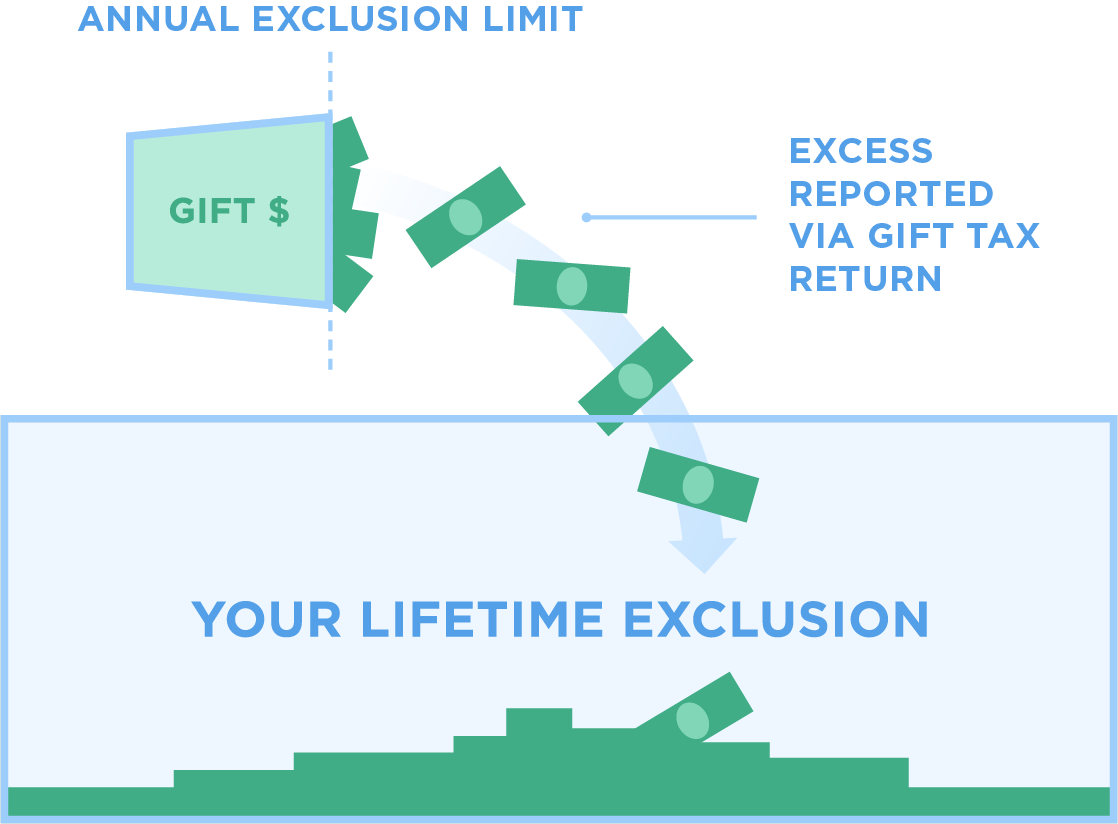

annual gift tax exclusion 2025 irs Trina Stack, Margot robbie forgoes barbie colors in a black versace gown at the 2025 oscars. Keep in mind that the annual gift tax exclusion 2025 is separate from the lifetime gift tax exemption, which you can use to make gifts exceeding the annual.

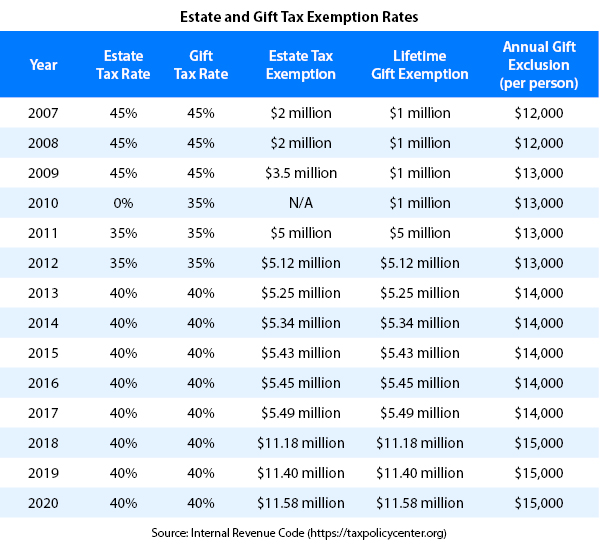

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The lifetime gift tax limit for 2025 is $13.61 million, up from $12.91 million in 2025. For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts.

What is the Lifetime Gift Tax Exemption and When Will It Be Cut? YouTube, Margot robbie forgoes barbie colors in a black versace gown at the 2025 oscars. Mar 10, 2025 6:06 pm est.

Can making lifetime gifts really reduce your tax liability in the future?, The annual exclusion applies to gifts to each donee. If current law expires, the federal lifetime tax exemption amounts will be cut roughly in half.

IRS Increases Gift and Estate Tax Thresholds for 2025, For 2025, the annual gift tax exclusion is $18,000, meaning a person can give up to $18,000 to as many people as he or she wants without having to pay any taxes on the gifts. Federal annual and lifetime gift tax exclusion increase for 2025 regarding annual gifts, the current (2025) federal annual gift tax exclusion is $17,000.00 per u.s.

The Best Credit Repair What is the Gift tax? How the Annual Gift Tax, Annual federal gift tax exclusion in 2025, an individual can make a gift of up to $18,000 a year to another individual without federal gift tax liability. An individual can gift a single recipient $17,000 without triggering the gift tax.

Q How does the lifetime gift tax exclusion work? Rose Law Firm of, In 2025, taxpayers can gift up to $18,000 to a person without reporting it to the irs on a federal gift tax return. The lifetime estate and gift tax exemption for 2025 deaths is $12,920,000.

Federal annual and lifetime gift tax exclusion increase for 2025 regarding annual gifts, the current (2025) federal annual gift tax exclusion is $17,000.00 per u.s.

So, the current (2025) lifetime gift tax exclusion is $12,900,000.00 and the new lifetime gift tax exclusion (2025) will be $13,610,000.00 per u.s.